Introduction:

In today’s financial landscape, individuals often find themselves in need of quick access to fundsTraditional lending institutions may not always be able to meet these urgent financial needs, especially for individuals with bad creditThis is where tribal loan lenders with guaranteed approval come into playIn this blog post, we will delve into the world of tribal loans, exploring what they are, how they work, and the benefits they offer to borrowers.

What are Tribal Loan Lenders?

Tribal loan lenders are financial institutions that are owned and operated by Native American tribes or tribal entitiesThese lenders operate under tribal sovereignty, which grants them certain legal protections and allows them to offer loans to borrowers across the United StatesTribal loans are an alternative to traditional payday loans and can provide borrowers with access to funds in a quick and convenient manner.

Guaranteed Approval

According to HummingbirdLoansz.com one of the key features that sets tribal loan lenders apart is their guaranteed approval processUnlike traditional lenders who heavily rely on credit scores and credit history, tribal loan lenders focus on other factors such as income and employment stabilityThis means that even individuals with bad credit or no credit history can still be eligible for a tribal loanThe guaranteed approval aspect of tribal loans provides borrowers with a sense of security and peace of mind, knowing that their loan application will be considered regardless of their credit situation.

Benefits of Tribal Loans:

Quick Access to Funds: Tribal loans are designed to provide borrowers with quick access to funds when they need it the mostThe application process is typically straightforward and can be completed online, allowing borrowers to receive funds in their bank account within a short period.

Flexible Repayment Options: Tribal loan lenders understand that each borrower’s financial situation is uniqueTherefore, they often offer flexible repayment options that can be tailored to the borrower’s needsThis can include longer repayment terms or the ability to make smaller, more manageable payments.

No Credit Check: As mentioned earlier, tribal loan lenders do not place a heavy emphasis on credit scores or credit historyThis means that individuals with bad credit or no credit can still be approved for a tribal loanThis opens up opportunities for those who may have been denied by traditional lenders due to their credit situation.

Tribal Sovereignty: Tribal loan lenders operate under tribal sovereignty, which provides them with certain legal protectionsThis can result in more favorable loan terms and conditions for borrowers, as tribal lenders are not bound by the same regulations as traditional lenders.

Conclusion:

Tribal loan lenders with guaranteed approval offer a viable solution for individuals in need of quick access to funds, especially those with bad credit or no credit historyThese lenders provide a convenient and flexible borrowing option, allowing borrowers to meet their financial needs without the stringent requirements of traditional lendersHowever, it is important for borrowers to carefully consider their financial situation and ensure they can comfortably repay the loan before proceedingTribal loans can be a valuable tool when used responsibly and can help individuals navigate through challenging financial circumstances.

How to Declutter Before a Big Move

How to Declutter Before a Big Move  Why Themed Entertainment Design Companies Are Quietly Shaping the Way We Experience the World

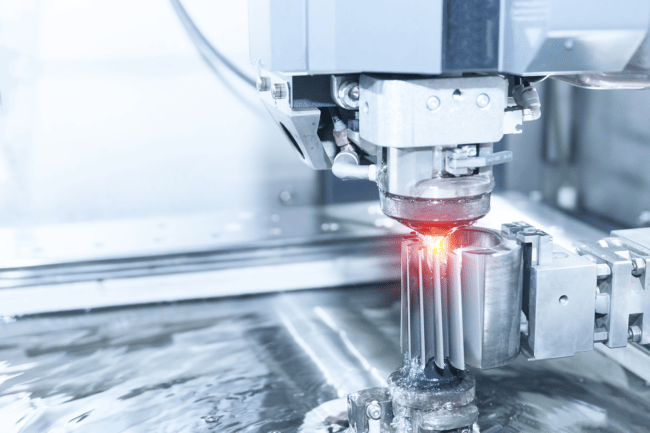

Why Themed Entertainment Design Companies Are Quietly Shaping the Way We Experience the World  Finding the Right CNC Lathe Machine Manufacturer: What You Really Need to Know

Finding the Right CNC Lathe Machine Manufacturer: What You Really Need to Know  The Real Reason People Buy Silver Bullion Perth Melbourne Gold Buyers Swear By

The Real Reason People Buy Silver Bullion Perth Melbourne Gold Buyers Swear By  Beyond the Defects: Warranties for Structure and Vital Systems

Beyond the Defects: Warranties for Structure and Vital Systems  Advancing Water Monitoring Technology with Boqu Instruments

Advancing Water Monitoring Technology with Boqu Instruments  The Clash of Tenures: Unpacking Rental Demand for Chuan Park vsThe Sen

The Clash of Tenures: Unpacking Rental Demand for Chuan Park vsThe Sen  Rose Gold Engagement Rings and Lab Made Diamond Choices

Rose Gold Engagement Rings and Lab Made Diamond Choices  Lab Grown Diamonds: Cost, Quality, and Buying Guide

Lab Grown Diamonds: Cost, Quality, and Buying Guide

:max_bytes(150000):strip_icc()/basketball-team-supporting-their-injured-teammate-on-the-court--966143760-75350a8b15ba4936813961288be70852.jpg)