Introduction

Timing is crucial when it comes to selling BitcoinAs one of the most volatile assets in the financial markets, Bitcoin’s price can fluctuate dramatically within short periodsUnderstanding the optimal time to sell can significantly impact your investment returnsIn this article, we’ll explore various strategies and considerations to help you determine the best time to sell your Bitcoin holdings.

Understanding Bitcoin Price Trends

Bitcoin’s price movements are influenced by a variety of factors best time to sell bitcoin, both fundamental and technicalHistorical data reveals patterns and cycles that can provide insights into when prices are likely to peak or dip.

Market Analysis

Analyzing current market trends and recent price fluctuations can offer real-time insights into Bitcoin’s market sentiment and price direction.

Fundamental Factors Impacting Bitcoin’s Price

Regulatory developments and economic indicators play a crucial role in shaping Bitcoin’s valuationUnderstanding these factors is essential for predicting price movements.

Technical Analysis

Key technical indicators and chart patterns help traders and investors identify potential entry and exit points, aiding in strategic decision-making.

Psychological Factors in Trading

Investor sentiment, often driven by fear, uncertainty, and greed, influences market dynamics and can impact Bitcoin’s price trajectory.

Seasonal Trends

Historical data shows that Bitcoin exhibits seasonal patterns, with certain months historically offering better selling opportunities than others.

Global Events and Their Impact

Geopolitical events and economic crises can either drive Bitcoin prices up as a safe-haven asset or cause sudden drops due to market volatility.

Comparative Analysis with Other Assets

Comparing Bitcoin’s performance against traditional assets like gold and stocks helps investors assess its role in a diversified portfolio.

Risk Management Strategies

Implementing effective risk management strategies, such as setting profit-taking targets and using stop-loss orders, is crucial for mitigating downside risks.

Long-term vsShort-term Selling Strategies

Deciding between holding Bitcoin for long-term gains versus selling for short-term profits requires understanding your investment goals and risk tolerance.

Expert Opinions and Market Predictions

Insights from industry experts and analysts provide valuable perspectives on future Bitcoin price movements and market trends.

Tax Implications of Selling Bitcoin

Navigating tax regulations related to cryptocurrency gains ensures compliance and minimizes tax liabilities.

Common Mistakes to Avoid

Identifying and avoiding common pitfalls in timing the sale of Bitcoin can help preserve capital and optimize investment returns.Bitcoin exchange platforms play a pivotal role in the cryptocurrency ecosystem, serving as marketplaces where users can buy, sell, and trade Bitcoin and other digital assetsThese exchanges facilitate transactions by matching buyers and sellers, often providing secure wallets for storing cryptocurrencies and advanced trading features such as limit orders and margin tradingAs the popularity of Bitcoin grows, so does the diversity and sophistication of exchange platforms, offering users around the globe access to a decentralized financial system and opportunities for investment and speculation.

Conclusion

Timing the sale of Bitcoin involves a blend of technical analysis, market sentiment assessment, and understanding fundamental factorsBy staying informed and adopting a strategic approach, investors can maximize opportunities to sell at favorable prices while managing risks effectively.

Sparkle in Style: Why Man Made Diamond Tennis Necklaces Are the New Luxury Must-Have

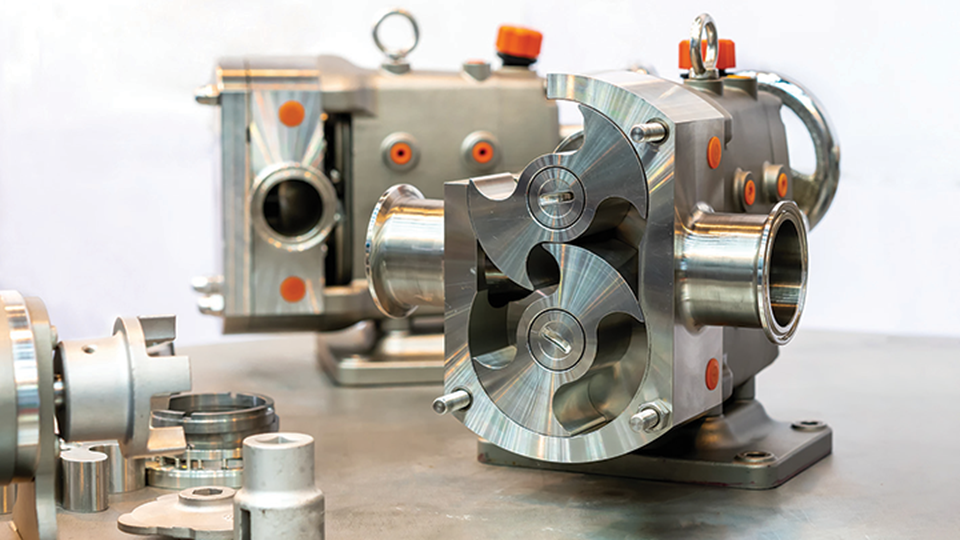

Sparkle in Style: Why Man Made Diamond Tennis Necklaces Are the New Luxury Must-Have  Material Matters: Choosing the Right Chemical Gear Pump for Corrosive Fluids

Material Matters: Choosing the Right Chemical Gear Pump for Corrosive Fluids  Investing in Pink Argyle Diamonds: A Valuable Opportunity in the World of Precious Gems

Investing in Pink Argyle Diamonds: A Valuable Opportunity in the World of Precious Gems  IGI o GIA: Understanding Lab-Made Diamonds

IGI o GIA: Understanding Lab-Made Diamonds  Lab Created Diamonds Are Forever: The Future of Sustainable Luxury

Lab Created Diamonds Are Forever: The Future of Sustainable Luxury  The Key Differences Between IGI and GIA Lab Grown Diamonds

The Key Differences Between IGI and GIA Lab Grown Diamonds  Lab Created Diamonds Are Forever: The Future of Sparkle

Lab Created Diamonds Are Forever: The Future of Sparkle  Relapse, Stress, And Addction: Preventions And Treatments

Relapse, Stress, And Addction: Preventions And Treatments  The Timeless Appeal of the Lab Diamond Tennis Bracelet

The Timeless Appeal of the Lab Diamond Tennis Bracelet

:max_bytes(150000):strip_icc()/basketball-team-supporting-their-injured-teammate-on-the-court--966143760-75350a8b15ba4936813961288be70852.jpg)