The Bank Nifty Options Chain is a treasure trove of information for traders seeking to make informed decisions in the dynamic and ever-changing banking sectorUnderstanding how to effectively interpret and utilize the data provided by the option chain can significantly enhance trading strategies and increase the chances of successIn this article, we will explore how traders can leverage Bank Nifty Option Chain data to make well-informed stock market trading decisions.

Analyzing Open Interest and Volume

Open interest and volume are critical components of the Bank Nifty Options Chain that provide valuable insights into market sentiment and liquidity using SIP CalculatorOpen interest represents the total number of outstanding options contracts for a specific strike price and expiration dateHigher open interest indicates more significant market interest and potentially higher liquidity for that particular option contractOn the other hand, declining open interest may suggest a decrease in market interest or an approaching expiration date.

Volume, on the other hand, measures the total number of options contracts in stock market traded during a given periodHigh volume indicates increased trading activity, making it easier to enter and exit positionsBy analyzing changes in open interest and volume, traders can identify shifts in market sentiment, spot potential price movements, and gauge the overall market’s outlook.

Identifying Support and Resistance Levels

The Bank Nifty Option Chain can also help traders identify potential support and resistance levelsSupport levels are price levels at which a decline in the Bank Nifty index is expected to be halted, leading to a potential price bounceResistance levels, on the other hand, are price levels at which an increase in the bank nifty option chain index is expected to be halted, leading to a potential price pullback using SIP Calculator.

Traders can analyze the open interest at various strike prices to identify areas with significant market interestHigher open interest at specific levels may indicate strong support or resistance areasBy incorporating this information into their trading options strategies, traders can make more informed decisions about entry and exit points, leading to improved risk management and potentially higher returns with the help of SIP Calculator.

Delta Analysis for Risk Management

Delta is a crucial option Greek that measures the sensitivity of an option’s price to changes in the underlying asset’s priceA positive delta for call options implies that the option’s price will increase with an increase in the Bank Nifty index, while a negative delta for put options implies that the option’s price will increase with a decrease in the bank nifty option chain index.

Stock market Traders can use delta analysis to assess their risk exposureFor example, if a trader expects the bank nifty option chain index to rise, they may prefer call options with higher positive deltas to gain more from the price increaseConversely, if a trader anticipates a decline in the Bank Nifty index, they may choose put options with higher negative deltasUnderstanding the delta of various options contracts enables traders to match their risk appetite and market outlook effectively.

The Final Thoughts

The Bank Nifty Options Chain empowers traders to construct various option strategies to capitalize on different market scenariosYou can try some common options strategies like straddle, strangle, spreads and so on using SIP Calculator.

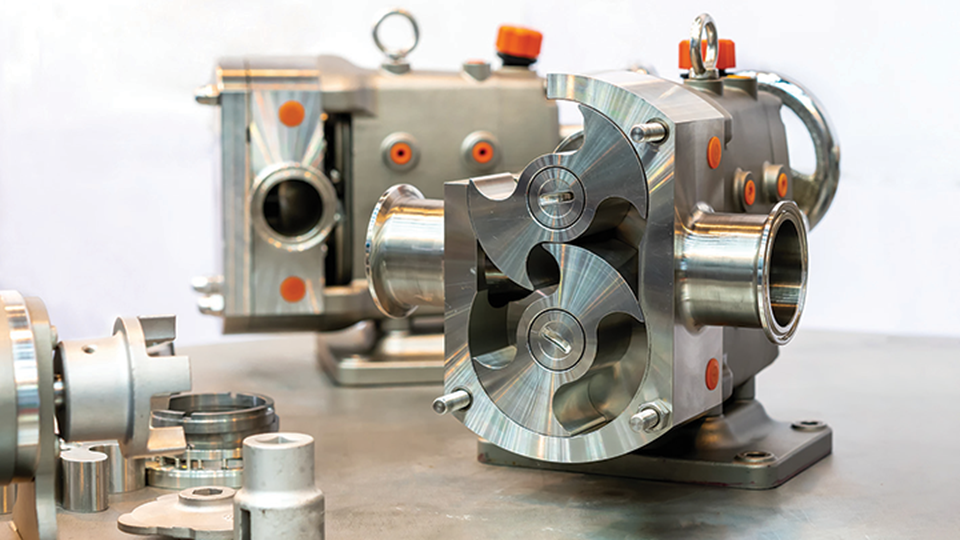

Material Matters: Choosing the Right Chemical Gear Pump for Corrosive Fluids

Material Matters: Choosing the Right Chemical Gear Pump for Corrosive Fluids  Investing in Pink Argyle Diamonds: A Valuable Opportunity in the World of Precious Gems

Investing in Pink Argyle Diamonds: A Valuable Opportunity in the World of Precious Gems  IGI o GIA: Understanding Lab-Made Diamonds

IGI o GIA: Understanding Lab-Made Diamonds  Lab Created Diamonds Are Forever: The Future of Sustainable Luxury

Lab Created Diamonds Are Forever: The Future of Sustainable Luxury  The Key Differences Between IGI and GIA Lab Grown Diamonds

The Key Differences Between IGI and GIA Lab Grown Diamonds  Lab Created Diamonds Are Forever: The Future of Sparkle

Lab Created Diamonds Are Forever: The Future of Sparkle  Relapse, Stress, And Addction: Preventions And Treatments

Relapse, Stress, And Addction: Preventions And Treatments  The Timeless Appeal of the Lab Diamond Tennis Bracelet

The Timeless Appeal of the Lab Diamond Tennis Bracelet  Brownstone Restoration and Repair Project Cost Breakdown

Brownstone Restoration and Repair Project Cost Breakdown

:max_bytes(150000):strip_icc()/basketball-team-supporting-their-injured-teammate-on-the-court--966143760-75350a8b15ba4936813961288be70852.jpg)