Ever wondered, what is the meaning of transit insurance? In simple words, an insurance plan that provides coverage for goods damaged while in transit from one location to another is known as a transit insurance policyThis insurance plan can be easily purchased online from leading insurance providers.

Transit refers to goods being transported over land, sea, or air from one location to anotherThis blog will discuss online transit insurance policies in detail; continue reading to learn more.

What Are The Types of Transit Insurance Online?

All kinds of people can purchase goods insurance in the logistics chain, such as the enterprise hired to transport the goods or the owner of the goods in transitBelow are some different types of transit insurance policies available; let’s examine them.

Single Transit Insurance

Some financial institutions provide insurance products that can offer single transit insuranceFor example, when you order machinery for your business from New York to Mumbai, you can typically opt for a single transit insurance.

As soon as the goods reach their destination, the insurance policy coverage endsSingle transit insurance is the best option if you own a company that carries out transit occasionally.

Third Party Transit Insurance

When a third-party logistics company outsources your company’s logistics operation, the goods will be delivered to your customers by the logistics company’s vehicleThis type of transit insurance policy covers goods damaged while in transit by the logistics services you outsourced.

Open Transit Insurance

Within the policy period, this transit insurance policy covers several shipmentsDuring the policy period, any damages that occur to your goods in transit across all shipments will be covered by this transit insurance policyIf you are a business owner who regularly carries out transit, consider getting open transit insurance.

Customised Transit Insurance

With a customised transit insurance policy, you can customise the insurance policy to fit your needsThis transit insurance policy can be customised based on location, vehicle type, goods, value, etcCustomised transit insurance can be very beneficial if you own a business that regularly ships different kinds of goods across different locations.

Multiple Vehicle Transit Insurance Policy

Some businesses use multiple vehicles to transport a shipment from one destination to another.

Big trucks are regularly picking up large-scale shipments to transport them across highwaysThese shipments are then picked up by smaller pickup trucks to deliver them to the customersA multiple vehicle transit insurance provides coverage for the entire shipment involving different vehicles..

How to Buy a Transit Insurance Policy?

- Before buying a transit insurance policy, research all the transit insurance policies available in India.

- Compare the transit insurance cost and coverage provided by multiple insurance companiesThis will help you choose the best transit insurance policy for your requirements and budget.

- Additionally, make sure you choose a reliable and reputable insurance company to ensure the best transit coverage.

- Once you have chosen a reliable insurance company, visit its official websiteThere, you will find a link to a transit insurance application formFill out the transit insurance application form carefully and submit it.

- Pay for the transit insurance premium to secure your insurance policyThe cost of a transit insurance policy depends on the risk the insured bears during the policy period and the goods being transported.

How to Claim Transit Cover Insurance?

- The first step in claiming transit insurance coverage is carefully filling out the claim form and submitting all the necessary documents.

- To find the claim form, visit the official website of the insurance company from which you purchased the transit insurance.

- Visit the website and navigate through the dashboard, you will find an available claim form.

- After submitting the claim form and documents, the insurer will appoint a surveyor who will examine the submitted documents and evaluate the claim based on the policy’s terms and conditions.

- After the assessment is done, the claim amount will be approved and the claim will be settled by crediting the insured’s account.

Documents Required to Claim Transit Insurance Coverage

- Original invoice of the goods being transported.

- Shipping details.

- Survey report.

- Copies of agreements between the carriers.

- Bill of lading.

- E-Way Bill.

- Any other documents demanded by the insurance company.

To Wrap It Up

Before purchasing a transit insurance policy, you must be aware of what the insurance policy includesAdditionally, ensure that the policy you are buying aligns with the risk of transporting your goodsTo completely understand the policy terms, you ask for the help of your insurance provider.

Lastly, make sure you know the exact cost of your insurance policy, as it includes the overall transit costs for the goods.

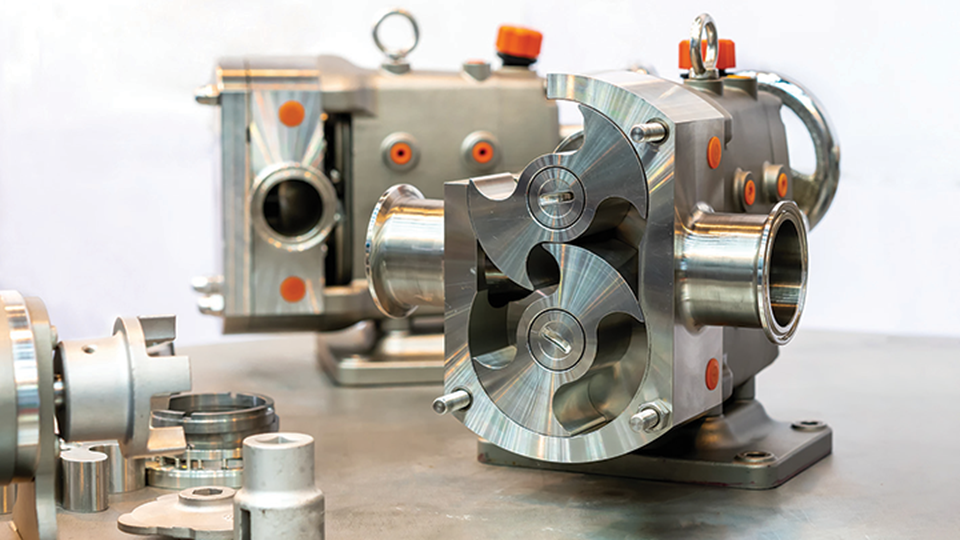

Material Matters: Choosing the Right Chemical Gear Pump for Corrosive Fluids

Material Matters: Choosing the Right Chemical Gear Pump for Corrosive Fluids  Investing in Pink Argyle Diamonds: A Valuable Opportunity in the World of Precious Gems

Investing in Pink Argyle Diamonds: A Valuable Opportunity in the World of Precious Gems  IGI o GIA: Understanding Lab-Made Diamonds

IGI o GIA: Understanding Lab-Made Diamonds  Lab Created Diamonds Are Forever: The Future of Sustainable Luxury

Lab Created Diamonds Are Forever: The Future of Sustainable Luxury  The Key Differences Between IGI and GIA Lab Grown Diamonds

The Key Differences Between IGI and GIA Lab Grown Diamonds  Lab Created Diamonds Are Forever: The Future of Sparkle

Lab Created Diamonds Are Forever: The Future of Sparkle  Relapse, Stress, And Addction: Preventions And Treatments

Relapse, Stress, And Addction: Preventions And Treatments  The Timeless Appeal of the Lab Diamond Tennis Bracelet

The Timeless Appeal of the Lab Diamond Tennis Bracelet  Brownstone Restoration and Repair Project Cost Breakdown

Brownstone Restoration and Repair Project Cost Breakdown

:max_bytes(150000):strip_icc()/basketball-team-supporting-their-injured-teammate-on-the-court--966143760-75350a8b15ba4936813961288be70852.jpg)