What is Credit?

Credit for customers is the financial power of the customer on an accelerated insight platformIt helps to get the things that are needed in the present time, like a loan for a car or a credit card, based on the promise to pay it later.

Good Credit and Bad Credit

Having good credit means regular payments are made on time until the outstanding balance is paid in fullAll financial institutions want to offer credit to customers who have the quality of making a payment on timeAlternatively, bad credit means having a hard time holding up the end of the bargain – not being able to pay the full minimum payments or not making payments on time.

Super Credit Tips

- Pay bills on time.

- Low balances on credit cards.

- Monitor credit reports ensuring there are no mistakes.

- Avoid too many credit options in a short period.

- Keep financial records in order and always look out for fraud and scams.

Superpowers of the customers: Good Credit

Different aspects of life are affected by credit ratingsThey are:

- Determining whether a lender approves a new loan.

- Influencing the interest rates and fees on the loan.

- Being reviewed by employers for a new job.

- Being used by landlords deciding whether to rent their flat.

- Determining the student loan eligibility.

A credit score is a measurement of the overall financial health and creditworthinessBecause credit is a key piece of the financial identity of a person, it is very crucial to build good credit early onWhile a poor score makes the biggest financial purchases more expensive, a good credit score, on the other hand, gives a competitive edge during lending decisions.

1Lower Interest Rates

One of the main benefits of good credit is the provision of lower interest rates on loansWhen a loan is applied, like a mortgage or credit card, a lender or provider uses the credit score to determine the interest rateThe lowest rates are for those applicants who have the highest scores and the applicants with lower credit scores receive higher interest rates.

2Increased chances to get qualified for a Loan or Credit

With a better credit score comes better approval of loansOf course, the credit score is not the only factor that is considered, but it is an important one.

3Approval for Certain Jobs

Those who work with money or in security clearance positions, or in the retail consumer financing department require a personal credit check to make sure that they are capable of handling financesHaving a poor credit score may lead to disqualification for certain positions.

4Larger Credit Card and Loan Limits

Good credit leads to eligibility for larger loans, such as the loans that are needed to take out a mortgage in some high-cost-of-living areasOne can also qualify for higher credit card limits.

5Better Credit Card Rewards

In addition to a credit limit of a higher range, a better credit score unlocks a wider variety of credit cards with benefitsThe best rewards cards require excellent credit for approval to enjoy the provision accumulated in themExamples of such cards are travel rewards cards to fully fund the vacations and cash-back rewards cards to earn a percentage back on your spending.

6Easier Approval for Rental Properties

Even if there is no plan to buy a house, a good credit score is neededMany people do not have this realisation, but the credit score is a factor that landlords take into consideration to accept the rental applicationHaving a good credit score leads to more chances to be approved as a tenant since a history of on-time payment behaviour is something to be more attractive to a landlord compared to someone with multiple delinquenciesIf not, then there is an obstacle to paying a higher deposit, agreeing to a short-term lease, or even being denied housing outright.

7Lower Insurance Rates

Good credit assists to save money on different kinds of insuranceInsurance companies use the credit score to decide whether to accept someone as a customer and how much to charge them, even though some officials refer to this practice to be unfair.

8Avoid Security Deposits on Utilities

A good credit score is very important when it comes to getting the utilities turned on, tooHaving a good credit score can lead the providers to switch on the utilities with a minimal amount of hassleBut with poor credit, they may require a deposit, or even have someone legally involved to agree to pay the bill if the party does notIt is similar to finding someone to co-sign on a loan – a co-applicant.

9Negotiating Power on Loan Terms

Not only can one get lower interest rates with a better credit score, but he/she can use it as a bargaining factor in the mortgage negotiation process as wellTo do this, one needs to prequalify and check his or her interest rate with multiple lendersThen, he or she can take his/her rate estimate around to different lenders to see if they can offer better terms, either by lowering the interest rate or waiving fees applicable for the loan.

Conclusion

Good credit for customers can save a huge amount of money if used wellBut on the other side, poorly managed credit can quickly turn into an expensive endeavourThe good news is though, even bad credit right now can be developed into good credit over time to gain access to the credit accounts desired in the future and open doors to opportunities where more and more people offer credit to customers with good credit scoresMaintaining a strong credit profile is crucial as the credit score plays a key role in major lending decisions.

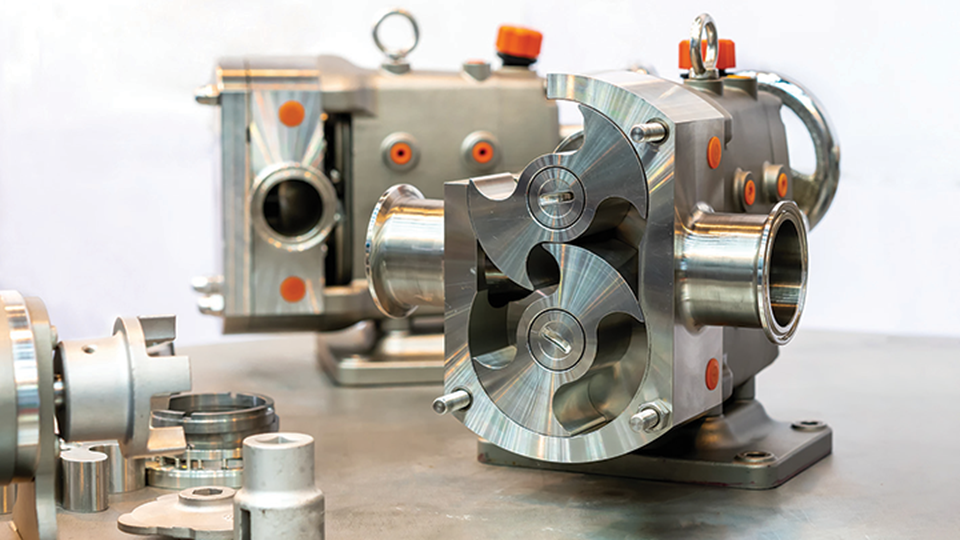

Material Matters: Choosing the Right Chemical Gear Pump for Corrosive Fluids

Material Matters: Choosing the Right Chemical Gear Pump for Corrosive Fluids  Investing in Pink Argyle Diamonds: A Valuable Opportunity in the World of Precious Gems

Investing in Pink Argyle Diamonds: A Valuable Opportunity in the World of Precious Gems  IGI o GIA: Understanding Lab-Made Diamonds

IGI o GIA: Understanding Lab-Made Diamonds  Lab Created Diamonds Are Forever: The Future of Sustainable Luxury

Lab Created Diamonds Are Forever: The Future of Sustainable Luxury  The Key Differences Between IGI and GIA Lab Grown Diamonds

The Key Differences Between IGI and GIA Lab Grown Diamonds  Lab Created Diamonds Are Forever: The Future of Sparkle

Lab Created Diamonds Are Forever: The Future of Sparkle  Relapse, Stress, And Addction: Preventions And Treatments

Relapse, Stress, And Addction: Preventions And Treatments  The Timeless Appeal of the Lab Diamond Tennis Bracelet

The Timeless Appeal of the Lab Diamond Tennis Bracelet  Brownstone Restoration and Repair Project Cost Breakdown

Brownstone Restoration and Repair Project Cost Breakdown

:max_bytes(150000):strip_icc()/basketball-team-supporting-their-injured-teammate-on-the-court--966143760-75350a8b15ba4936813961288be70852.jpg)