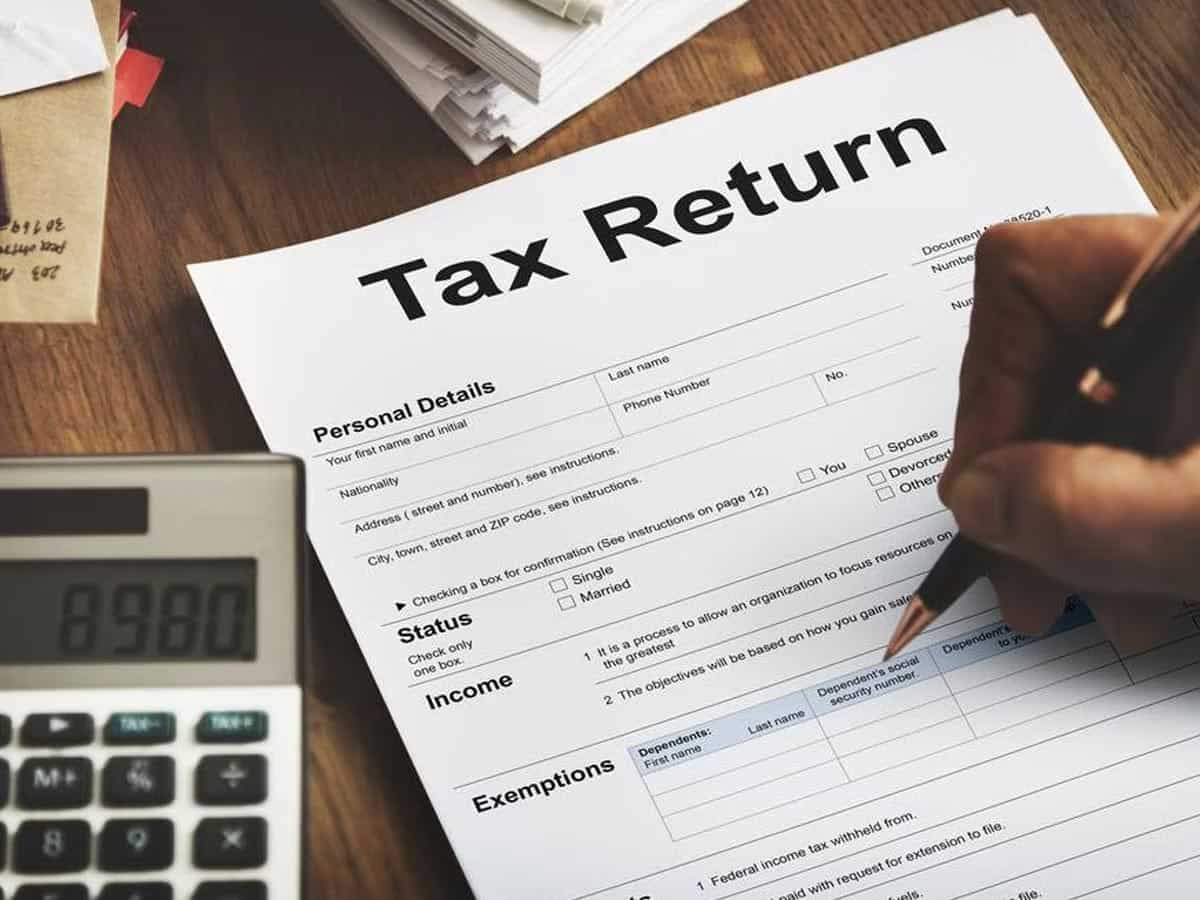

An income tax return provides a concise overview of your earnings during the fiscal yearIt is crucial to fulfil your tax obligations by submitting your returns to the income tax department annuallyNeglecting to pay your taxes or failing to file your ITR can result in fines and penalties.

Therefore, you must file your returns each year on time to avoid such complications.

Here is an overview of what you need to understand about filing your returns and the penalty for late filing of ITRAdditionally, The late submission of ITRs may potentially result in your employer suspending or terminating your job.

Also read: Amazing Hacks Using Which You Can Finance Your Customers

What are the Penalties for Not Submitting Income Tax Returns Under Different Sections?

Here is a table outlining the different types of penalties applicable for not filing your ITR:

| Sections | Offence Type | Penalty |

| Section 234F | Late filing of ITR after the due date | The penalty for late filing is ₹5000 if the ITR is filed before 31st December of the Assessment Year and ₹10,000 if filed after 31st December but before 31st March of the Assessment Year for individuals with income above ₹5 lakhsFor those with income below ₹5 lakhs, a penalty of ₹1000 is levied. |

| Section 234A | Failure to file ITR within the due date and have an outstanding unpaid tax | 1% interest per month or part of the month on the outstanding tax amount since the due date. |

| Section 271H | Failure to submit TDS and TCS returns within the specified deadline | Ranges from ₹10,000 to ₹1 lakh, in addition to the late filing penalty under Section 234E, which incurs a charge of ₹200 per day until the TDS/TCS is settled. |

| Section 270A | An individual needs to file their ITR or be discovered to have underreported their taxable income. | The penalty is 50% of the total tax payable on the income for which no return was submitted. |

Also read: Understanding the Tax Implications of Group Health Insurance

What are the Consequences for Non-Filing ITR?

Not filing your ITR can lead to serious consequences, including legal and financial penalties:

- Legal Consequences: If you do not file your ITR, there is a high chance that you will be sent a notice from the Income Tax Department, or you may even get prosecuted under the Income Tax Act.

- Financial Penalties: Missing the deadline for filing ITR can attract penalties, interest charges and fines.

- Difficulty Obtaining Loans: The lack of an ITR filing may make it challenging to obtain loans since lenders typically require this document.

- Refund Delays: If you fail to file your ITR, there may be a delay in receiving any income tax refund owed, and you may miss out on claiming any refunds.

What is the Process for paying the ITR Penalty Online?

Here is how you can clear your penalty for late filing of income tax return online:

Step 1: Go to the official portal of income tax e-filing.

Step 2: Click the ‘e-Pay Tax’ option in the left column.

Step 3: You will be redirected to the NSDL website for paymentClick on the provided link.

Step 4: Under ‘CHALLAN NO./ITNS 280’, choose ‘Proceed’ on the NSDL website.

Step 5: Fill out the payment form displayed on the next page.

Step 6: If you are an individual taxpayer settling the penalty for late ITR filing, opt for ‘(0021) Income Tax (Other than Companies)’ for ‘Tax Applicable’Then, under ‘Type of Payment’, choose ‘(300) Self Assessment Tax’ and proceed by scrolling down.

Step 7: Choose ‘Net Banking’ or ‘Debit Card’ as your payment mode and select your bank from the drop-down menu.

Step 8: Provide your bank account number and select the correct assessment year.

Step 9: Enter your address details, email ID, and mobile number, and complete the security check.

Step 10: Review the filled-in challan for accuracy and make any necessary editsThen, click ‘Submit to the Bank’.

Step 11: Sign in to your bank account on the payment page and enter the penalty amount in the designated fieldIf you must also pay outstanding tax, enter the amount accordingly and confirm the payment.

Hence, you must carefully file the ITR before the due date to avoid penalties and problemsIf you end up not filing your ITR on time, pay the required penalties and aim to file the next one before the deadline.

How to Declutter Before a Big Move

How to Declutter Before a Big Move  Why Themed Entertainment Design Companies Are Quietly Shaping the Way We Experience the World

Why Themed Entertainment Design Companies Are Quietly Shaping the Way We Experience the World  Finding the Right CNC Lathe Machine Manufacturer: What You Really Need to Know

Finding the Right CNC Lathe Machine Manufacturer: What You Really Need to Know  The Real Reason People Buy Silver Bullion Perth Melbourne Gold Buyers Swear By

The Real Reason People Buy Silver Bullion Perth Melbourne Gold Buyers Swear By  Beyond the Defects: Warranties for Structure and Vital Systems

Beyond the Defects: Warranties for Structure and Vital Systems  Advancing Water Monitoring Technology with Boqu Instruments

Advancing Water Monitoring Technology with Boqu Instruments  The Clash of Tenures: Unpacking Rental Demand for Chuan Park vsThe Sen

The Clash of Tenures: Unpacking Rental Demand for Chuan Park vsThe Sen  Rose Gold Engagement Rings and Lab Made Diamond Choices

Rose Gold Engagement Rings and Lab Made Diamond Choices  Lab Grown Diamonds: Cost, Quality, and Buying Guide

Lab Grown Diamonds: Cost, Quality, and Buying Guide

:max_bytes(150000):strip_icc()/basketball-team-supporting-their-injured-teammate-on-the-court--966143760-75350a8b15ba4936813961288be70852.jpg)