Are you a beginner trader looking for a way to increase your funds without taking on too much risk? Trading with covered calls may be the perfect option for youCovered calls are considered one of the most basic options trading strategies and can be used as part of an overall portfolio strategy.

This article will discuss precisely what covered calls are, how they work, and how you can use them in your own trading decisionsRead on to learn more about this powerful tool that could give your investments the extra boost they need.

What Are Covered Calls, And How Do They Work

Covered call investing is an excellent way for investors to add extra income to their portfolio – with potentially minimal riskA covered call is an options strategy where an investor holds a long position in the underlying security and sells call options on that security, thus “covering” the calls they wrote.

By writing (selling) the call, the investor receives a premium, while at the same time, they are obligated to sell the underlying security at a specific price (the strike price) if it is called awayIt’s worth researching further, as this strategy has many advantages, such as limiting downside risk and adding additional income when holding stocks.

Benefits Of Using Covered Callstrading

When trading covered calls, there are several potential benefitsBy trading options, you can limit your downside risk while taking advantage of upside potential if the underlying security rises in priceTrading with covered calls is a great way to create additional income without taking on too much risk.

Also, trading with covered calls can protect your investment ina stockYou can also use this trading strategy to hedge against a potential fall in the value of a stock by writing covered calls with strike prices lower than the current trading price.

Finally, trading with covered calls can also be used when trading volatile stocksBy writing a call on a stock, you can reduce the overall volatility of your trading strategy and increase the likelihood of making money in uncertain market conditions.

Risks Associated With Using Covered Calls

It’s also essential to know the risks associated with trading covered callsFor example, if you write a call and the underlying stock rises in value, you may miss out on potential opportunities that could have been realised by holding on to the stockIt is known as an opportunity cost risk.

Another risk associated with trading covered calls is the time decay riskTime decay occurs when the value of an option decreases as it gets closer to expirationIt means that if you write a call, and the underlying stock doesn’t move in price, your opportunity will erode over time due to this time decay effect.

Finally, another risk associated with trading covered calls is being assigned earlyIf the underlying stock rises above your strike price before expiration, then you may be assigned early and forced to sell the stock at a lower price than expected – thus negating any benefit you could have made by holding on to it.

Tips For Trading With Covered Calls

Several tips can help you maximise your advantages and minimise the risk associated with this strategy when trading with covered calls.

Firstly, choosing an appropriate strike price for your call option is essentialThe strike price should be low enough so that you can benefit from any potential rise in the underlying stock while still limiting your downside risk.

Also, selecting a reasonable expiration date for your option is crucialGenerally, you want to choose an expiration date that is at least six weeks out to give the stock enough time to move.

Finally, stay up to date on news and market conditions that may affect the price of your underlying stockIt will help you make more informed trading decisions and ensure that you enter intoadvantageous trades.

How To Start Trading With Covered Calls

If you want to start trading with covered calls, the first step is to set up a brokerage accountEnsure that your broker offers options trading and that they have access to the stocks you are interested in trading.

Once your account is opened, you can begin researching different stocks and evaluating which ones may be good candidates for writing covered callsIt would help if you looked for stocks with a high level of volatility and are likely to move in price over the next few weeks.

Once you have identified a stock, you can purchase it and write a call option against itSelect an appropriate strike price, expiration date, and many contracts that best fit your trading strategy.

Finally, once you have written the call option, monitoring the stock and taking action if needed is crucialIf the underlying stock rises above your strike price before expiration, you may need to close out your position early to avoid being assigned early.

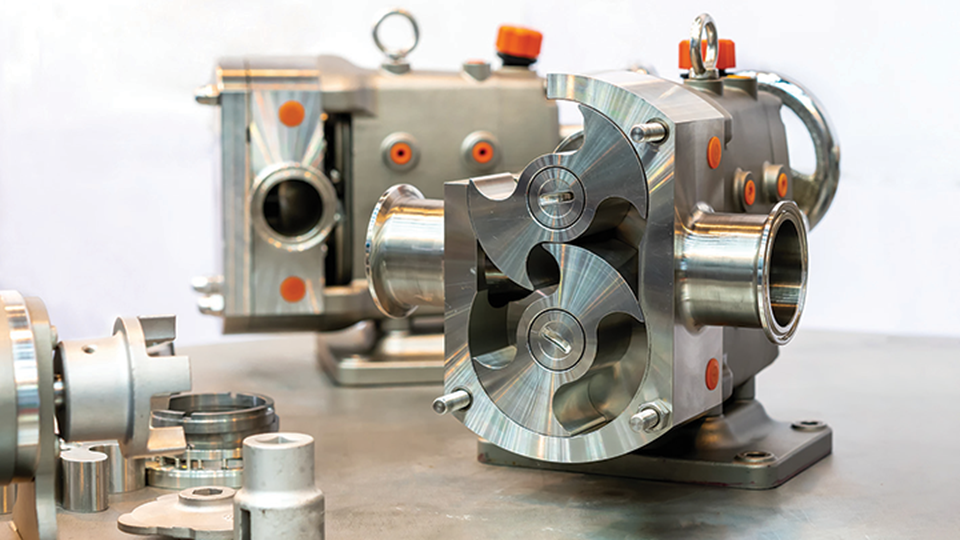

Material Matters: Choosing the Right Chemical Gear Pump for Corrosive Fluids

Material Matters: Choosing the Right Chemical Gear Pump for Corrosive Fluids  Investing in Pink Argyle Diamonds: A Valuable Opportunity in the World of Precious Gems

Investing in Pink Argyle Diamonds: A Valuable Opportunity in the World of Precious Gems  IGI o GIA: Understanding Lab-Made Diamonds

IGI o GIA: Understanding Lab-Made Diamonds  Lab Created Diamonds Are Forever: The Future of Sustainable Luxury

Lab Created Diamonds Are Forever: The Future of Sustainable Luxury  The Key Differences Between IGI and GIA Lab Grown Diamonds

The Key Differences Between IGI and GIA Lab Grown Diamonds  Lab Created Diamonds Are Forever: The Future of Sparkle

Lab Created Diamonds Are Forever: The Future of Sparkle  Relapse, Stress, And Addction: Preventions And Treatments

Relapse, Stress, And Addction: Preventions And Treatments  The Timeless Appeal of the Lab Diamond Tennis Bracelet

The Timeless Appeal of the Lab Diamond Tennis Bracelet  Brownstone Restoration and Repair Project Cost Breakdown

Brownstone Restoration and Repair Project Cost Breakdown

:max_bytes(150000):strip_icc()/basketball-team-supporting-their-injured-teammate-on-the-court--966143760-75350a8b15ba4936813961288be70852.jpg)