Losing money in the Forex market is very commonBut the new traders in Hong Kong don’t know the proper way to embrace losing tradesThey are always taking a huge risk to recover the lossBut such an aggressive approach always results in heavy lossesIf you really want to make a living out of trading, you must learn to identify the mistakes in your trading systemThough there are many things you need to consider today we will highlight some of the key reasons for which are blowing up the trading accountThe main reasons for losing money include:

- Overtrading

- Lack of knowledge

- Trading against the market trend

- Taking a huge risk in each trade

Overtrading

Overtrading is one of the main reason for which the rookie traders are losing moneyMost of the time they think this is the only way to make a profitBut just have a look at the experienced traders in Hong KongIt won’t take much time to understand why they never overtrade the marketYou need to find high-quality trade setups and only then you will be able to make a profit in the long runAnd to do so, you must trade the higher time frameThough higher time frame trading is extremely boring, once you start to understand the nature of this business, you will never overtrade.

Lack of knowledge

Knowledge is the most essential part of the trading businessWithout having precise knowledge about the Forex industry, you are bound to lose moneyBeing a new trader in Hong Kong, you should visit https://www.home.saxo/en-hk to learn more about this industryThere are three basic types of market analysis which you need to learnLearning the technical part is really easy but when it comes to fundamental analysis, you will have to work really hardFundamental factors are often considered as the most complex part of this marketBut if you seek help from the trained traders, they will give you proper guidelines to trade the high impact news.

Trading against the market trend

Trading against the market trend is one of the key reasons for which you are losing moneyIt’s true, at times you will find many high-quality trading signals but if you consider the long term trend, you will notice it’s more like trading against the market trendThe majority of the rookie traders will execute the trade at such a moment but when it comes to the professional traders they will simply ignore the trade setup.

Taking a huge risk in each trade

Those who are new to the trading industry, often take a huge risk in the marketThey simply want to make more money from this marketBut taking a huge risk in each trade is nothing short of gamblingIf you want to survive in the market, you must trade the market with low-risk exposureNo matter how good you understand this market, you should never execute any trade with more than 2% riskManaging the risk factors in the trading business is the most difficult taskYou might be very skilled with your trading profession but this doesn’t mean you should execute the trade with high riskMaking consistent profit is a very challenging taskYou need to rely on long term goals and trade the market with proper logicAs a currency trader, you need to focus on quality trade setupsNever take things seriously unless you know the proper way to deal with this market.

Conclusion

Making consistent profit in the Forex market is one of the most difficult tasks in any businessHowever, if you learn to trade the market with proper discipline it won’t take much time to develop your skills learning to trade the market is an artOnce you learn to deal with the complex nature of the market, you can easily make a profit and change your life.

Sparkle in Style: Why Man Made Diamond Tennis Necklaces Are the New Luxury Must-Have

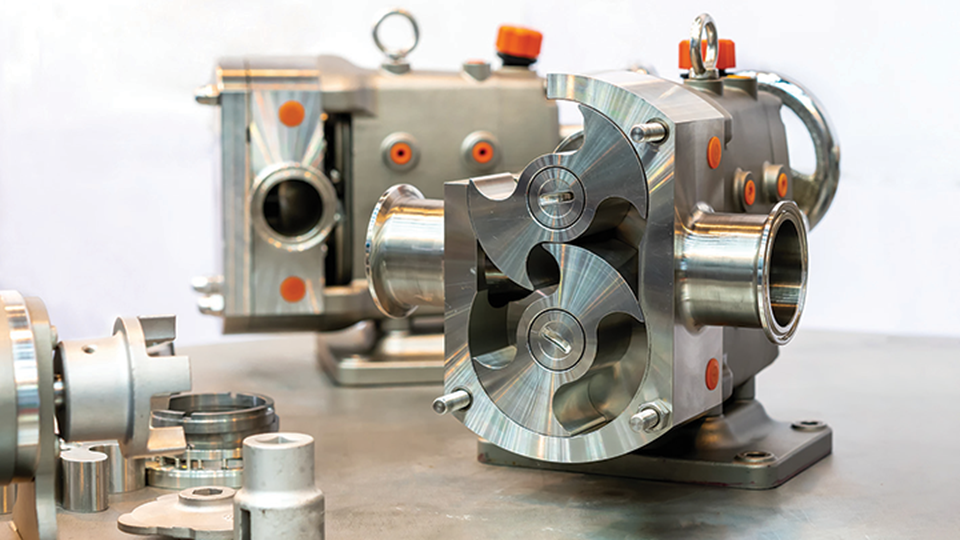

Sparkle in Style: Why Man Made Diamond Tennis Necklaces Are the New Luxury Must-Have  Material Matters: Choosing the Right Chemical Gear Pump for Corrosive Fluids

Material Matters: Choosing the Right Chemical Gear Pump for Corrosive Fluids  Investing in Pink Argyle Diamonds: A Valuable Opportunity in the World of Precious Gems

Investing in Pink Argyle Diamonds: A Valuable Opportunity in the World of Precious Gems  IGI o GIA: Understanding Lab-Made Diamonds

IGI o GIA: Understanding Lab-Made Diamonds  Lab Created Diamonds Are Forever: The Future of Sustainable Luxury

Lab Created Diamonds Are Forever: The Future of Sustainable Luxury  The Key Differences Between IGI and GIA Lab Grown Diamonds

The Key Differences Between IGI and GIA Lab Grown Diamonds  Lab Created Diamonds Are Forever: The Future of Sparkle

Lab Created Diamonds Are Forever: The Future of Sparkle  Relapse, Stress, And Addction: Preventions And Treatments

Relapse, Stress, And Addction: Preventions And Treatments  The Timeless Appeal of the Lab Diamond Tennis Bracelet

The Timeless Appeal of the Lab Diamond Tennis Bracelet

:max_bytes(150000):strip_icc()/basketball-team-supporting-their-injured-teammate-on-the-court--966143760-75350a8b15ba4936813961288be70852.jpg)